The Ultimate Guide to Finding and Winning College Scholarships

/A hands-on primer to helping your child earn thousands of dollars in free money, eliminate college debt, and live with less financial worry

----

Part 1: Introduction

Perhaps the only thing more stressful than getting into college is finding ways to pay for it. You’ve read and heard stories about families taking on significant debt just to put their children through college. This debt can take years—sometimes decades—to pay off.

On the other hand, you may have also read and heard stories about families whose children graduated from college completely debt-free. Students who receive enough financial support to attend and graduate from college with no debt can:

Focus more on school and building lifelong relationships, and less on working for pay.

Pursue their dream career rather than be handcuffed to less desirable but higher paying jobs simply because they have to make massive loan payments.

Nevertheless, being part of the debt-free club doesn’t just happen. After all, unless your child is part of the academic elite (that is, in the top 1–10 percent in the country in terms of grades, ACT or SAT scores, and extracurricular accomplishments), they likely won’t get enough merit-based financial aid to cover all college costs. In fact, some colleges don’t even offer merit-based scholarships.

Similarly, unless your family can demonstrate great financial need, your child won’t get enough need-based financial aid to cover all college costs.

The good news, however, is that your child may not need to cover all college costs. Rather, after receiving some grants (i.e., free money) from colleges and federal and state governments, the remaining portion can be paid off with scholarships.

How much does college cost?

Let’s take a quick moment to review how much college actually costs, not just what we’ve heard out in the wild.

According to The College Board, the cost of college during the 2022–2023 academic year rose by 3.5 percent at private nonprofit four-year colleges, 1.8 percent at public four-year in-state colleges, 2.2 percent at public four-year out-of-state colleges, and 1.6 percent at public two-year colleges, after adjusting for inflation.

These increases brought current average prices up to the following:

Tuition and fees

Private nonprofit four-year: $39,400

Public four-year in-state: $10,950

Public four-year out-of-state: $28,240

Public two-year in-district: $3,860

Room and board, books, and other fees

Private nonprofit four-year: $18,170

Public four-year in-state and out-of-state: $17,000

Public two-year in-district: $15,370

Total

Private nonprofit four-year: $57,570

Public four-year in-state: $27,940

Public four-year out-of-state: $45,240

Public two-year in-district: $19,230

Those are some big numbers. But, before you close your browser and run for the hills and away from the college debt monster, keep in mind the big secret alluded to a brief moment ago:

Most students will not have to pay the full listed prices (i.e., the sticker prices) of college tuition, room, and board. Some of this amount will be covered via grants. The rest of it can be covered via (avoidable) loans, (avoidable) work, and (winnable) scholarships.

In other words, it’s entirely possible for your child to graduate from college debt-free.

In fact, many colleges with the highest sticker prices—mostly private schools—can also be the most affordable. Their high levels of endowment allow them to cover a large percentage of tuition (or even the entire bill) for students who come from families with lower- and middle-class incomes. Prestigious schools like Harvard, Brown, and Stanford all promise free tuition to students under a specified income level. Money is not so much an issue for these schools; recruiting the top students is.

Why you and your child should focus your energy and effort on obtaining college scholarships

Reason 1: Financial ROI

Beyond the wonderful gift of receiving money your child and family will never have to pay back, it’s important to understand the incredible financial return on investment (ROI) on your time spent applying for college scholarships.

Back in 2014, the folks at Scholarship Opportunity completed a wonderful analysis to answer the following question: Are scholarships worth it? The answer was—and still is—a resounding YES.

Scholarship Opportunity found that the hourly wage earned by applying for scholarships—completing applications, writing essays, etc.—is $66/hour, or $516/day, which is much more than what most people ever make.

Therefore, if graduating with little to no debt is a major priority for your child and family, there’s simply no better way to spend your effort than to apply for as many scholarships as possible.

Reason 2: Prestige ROI

In addition to the incredible financial ROI provided by college scholarships, they also provide a “prestige ROI.”

Specifically, students who win one or more scholarships are more likely to win additional scholarships because their résumé will look much more impressive.

Think about it: if a scholarship committee evaluates two students with equal academic and extracurricular profiles, but one of the applicants has several more awards—scholarships or otherwise—listed on their résumé, which applicant do you think will receive the scholarship? Of course, the student with more awards!

One myth related to this point that needs to be dispelled is the idea that scholarship organizations may not want to fund students who have already won scholarships because they may feel those students already have enough money. In fact, the opposite is true: students with other scholarships represent a safe bet that the scholarship committee will be funding a superstar.

Reason 3: Scholarships often have less competition than grants

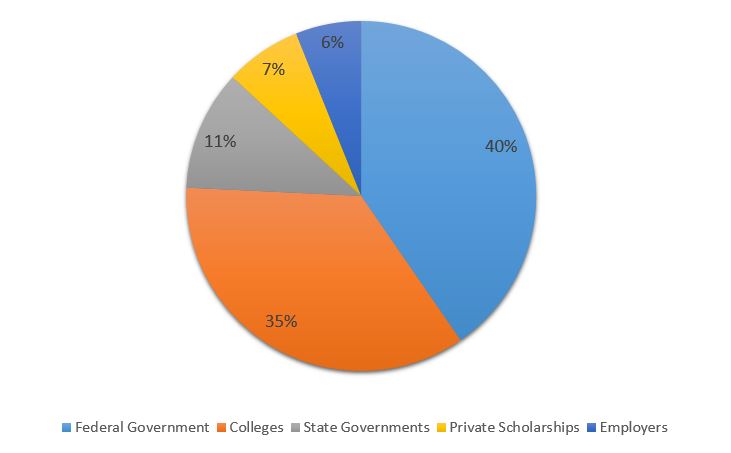

Let’s take a look at the following chart that depicts the percentage of scholarship and grant funding provided by various public and private entities:

As you can clearly see, colleges and the federal government collectively offer 75 percent of grant and scholarship money, much more than state governments, private scholarships, and employers.

After showing parents this chart during live seminars, I ask them, based on this information, where should they search for free money? Without fail, 95+ percent of them answer, “The federal government and colleges.”

Now, wherever most families will primarily look for college funding, that’s where the greatest competition will be. If we were talking about sports, competition would be a good thing. On the other hand, when we’re talking about a limited pool of free money, competition is the last thing we want.

Therefore, after taking the time to file your child’s FAFSA, I would encourage you to focus where few others are: private scholarships, including those from employers (more on this later).

Scholarships can help you eliminate college debt—and I’m living proof

When I started my freshman year of college at UCLA during the 2004–2005 academic year, tuition was $6,575.52. I received grants totaling $3,000/year, leaving a $3,575.52 difference. With scholarships, I covered that difference and then some, and was even refunded several thousands of dollars per quarter.

I transferred to Cornell University at the start of the 2006–2007 academic year, where the listed tuition was a much higher $31,881. Still, I received $29,000/year and offset the $2,881 difference through scholarships.

For graduate school, I returned to UCLA. Whereas my >$10,000 tuition was covered by the psychology department and outside funding agencies, I covered all of my living costs through—you guessed it—scholarships.

During my nine years of college and graduate school, I received over $200,000 in tuition support and stipends for living expenses through scholarships alone.

While tuition costs have gone up significantly since I started college—especially at public colleges and universities—the same tactics I used to graduate debt-free can help your family replicate my results today.

Who am I? My name is Dr. Shirag Shemmassian, founder and CEO of Shemmassian Academic Consulting. I’ve helped hundreds of students get into America’s top colleges and graduate schools. Moreover, I’ve helped many of these students significantly reduce—or even eliminate—their educational debt through scholarship advising.

When I share my story about graduating debt-free from Cornell University with my B.S. in Human Development and from UCLA with my Ph.D. in Clinical Psychology, I don’t do it to brag. Instead, my goal is to empower you so you can make college an affordable reality for your family.

Let's dive in.

----

Part 2: Where and when to search for and find college scholarships

Where to search for college scholarships

Have you ever heard people say something to the effect of: “There’s tons of free money out there! You just have to go find it!”? If you’re like most parents, you’ve probably wondered, “OK, so where is it? Where should I look?”

Great question.

There are several different categories of places to look for scholarships, each with their own pros and cons. We’ll start with the most well-known places to search for scholarships and move toward the less well-known ones.

Given that each of the scholarship strategies described below have their pros and cons, I recommend you use them all to supplement one another, rather than exclusively rely on one or two.

Online scholarship databases

There are many scholarship databases online that compile thousands, sometimes millions of scholarships, and match your family to them based on your child’s year in school, GPA, state and city of residence, extracurricular interests, and so on.

Some of the most popular scholarship databases include Cappex, Chegg, The College Board, Fastweb, Scholarships.com, and Scholly.

Pros: Nothing comes close to the sheer number of scholarships that can be found through online scholarship databases. Chances are, your child’s background information will meet eligibility criteria for hundreds of scholarships.

Cons: The cons of using online scholarship databases aren’t exactly the databases’ fault. Nevertheless, I’ll describe them.

First, many of the scholarships found on these databases will end up receiving thousands of applications, simply because most families find scholarships through these websites. In other words, the competition for many of the scholarships is quite high.

Second, there are many “low-quality” scholarships found through these databases, such as those that have few eligibility requirements, whose primary goal is to collect physical and email addresses to send further promotions to.

Despite these cons, you can find several “diamonds in the rough” through online scholarship databases. Therefore, I recommend you include online scholarship databases as part of any college scholarship search.

College applications

While completing various college applications, your child will likely come across questions asking whether they would like to be considered for certain scholarships. Some of these scholarships opportunities are extended to all applicants, whereas others are only extended to students who meet certain eligibility criteria (e.g., state of residence, ethnocultural background).

Pros: Scholarship opportunities extended through college applications are the easiest to come across. To discover them, you simply have to go through the process of applying for college. If you’re reading this guide, you probably will or already have done that!

Cons: Again, given that these scholarships are so easy to find, many students will apply for them. While that shouldn’t be a deterrent, know that these scholarships will have greater competition for them.

School counselors

While a large number of scholarships can easily be found through online scholarship databases and college applications, many others aren’t listed in either of these sources. High school and college counselors may know about several scholarships not listed on larger databases that your child is eligible to apply for; all you have to do is ask.

And don’t feel limited to only asking your school’s counselor. Typically, counselors at other local schools are also happy to help you find great scholarships.

Pros: High school and college counselors are often able to point you to high-paying, low-competition scholarship opportunities that you simply wouldn’t have known about otherwise. They can also help you sort through the hundreds of scholarship opportunities you come across on online scholarship databases.

Cons: School counselors often have a large number of students they are required to support. Therefore, the onus will largely be on you and your child to approach them for help. Moreover, school counselors simply won’t know about the many scholarships listed on online databases, as well as niche scholarships you can find on your own (see the following section for more information). Therefore, you shouldn’t exclusively rely on school counselors for your scholarship search.

Manual searches for private scholarships

The greatest hidden gems are typically found through conducting manual searches for private scholarships (i.e., niche scholarships).

The best approach to finding private scholarships is to first list everything about your child’s and family’s background, including your ethnocultural background, place of employment, and place of residence, as well as your child’s gender, extracurricular interests, disability status, etc.

Next, you should conduct online searches via Google or similar search engines for every single item on your list to see what scholarship opportunities are available to your family. For example, if you search for scholarships for students with disabilities, you may come across Nitro's awesome resource: 131 Scholarship Opportunities for Students with Disabilities.

In college, nearly all of the scholarship money I earned came from private scholarships I found through such manual searches.

Pros: Private scholarships typically have the lowest competition, for the following two reasons: they often don’t appear on online scholarship databases, and they have very targeted eligibility requirements (e.g., belonging to a specific ethnocultural group).

Cons: Finding private scholarships that your child is eligible for perhaps requires the most effort and creativity of all the listed approaches. Your search will be most effective after deep brainstorming about your child’s and family’s background.

When to search for college scholarships

I’ll break down this shorter section in two ways: the best time of year to search for scholarships and the ideal grade levels during which to search for scholarships.

First, what’s the best time of year to search for college scholarships?

Most scholarship applications tend to be due in the fall (October–November) or spring (March–May).

That said, several scholarship applications your child is eligible for will likely be due outside of these months. Therefore, it’s worthwhile to conduct a quarterly scholarship search and plan ahead.

And during what grade levels should you search for college scholarships?

Whether your child is in 10th grade, 12th grade, or in their sophomore year of college, there will likely be various scholarships they are eligible to apply for. Nevertheless, most scholarships require students to be in 12th grade or in college at the time of application.

(Suggested reading: The Ideal College Application Timeline)

How to stay organized with college scholarship applications

Keeping track of all of the great scholarship opportunities you find can be challenging. Therefore, I strongly recommend you stay organized with a spreadsheet containing the following pieces of information for each scholarship:

Name of scholarship

Scholarship website

Application due date (and if submitting via regular mail, specify whether it needs to be postmarked or received by the due date)

Eligibility requirements*, such as:

Grade in school

Race/ethnicity

Citizenship

Disability status

Extracurricular activity participation

Application requirements, such as:

Transcripts

Test scores

Cover letters (including name and address of recipient)

Essays (including the number of essays, essay prompts, and word or character count)

Recommendation letters, including:

The number of letters

Types of letters (e.g., from a teacher or from a coach)

How letters should be sent (e.g. uploaded to online application vs. mailed, mailed directly by recommender vs. included in larger application envelope)

Additional materials (e.g., art portfolio, athletic highlight reel)

Interviews

Submission method and instructions (i.e. regular mail vs. email, name and address of recipient)

*Please note that eligibility requirements can sometimes be confusing. If you have any questions or need further clarification whether or not your child qualifies for a certain scholarship, please get in touch with the scholarship organization immediately. They’ll be glad to help.

----

Part 3: How to apply for—and win—college scholarships

Once you’ve searched for and found scholarships that your child is eligible for and organized them all in a spreadsheet, it’s time to apply to as many as you possibly can.

I cannot stress this point enough. Winning college scholarships is largely a numbers game; the more you apply for, the more you are likely to win. Moreover, the more scholarships you win, the more likely you are to win others (see Reason 2: Prestige ROI, above).

Most people (including me) that you hear or read about who earned tens—sometimes hundreds—of thousands of dollars in scholarships to graduate college debt-free simply applied for so many more scholarships than everyone else did.

It’s rare for students to win one or two scholarships that will cover all of higher education; there just aren’t very many of those types of scholarships. Rather, the most financially savvy students understand that $1,000 here, $500 there, another $3,000 from another organization, and so on, quickly add up and can help pay for the bulk of college expenses.

If this all sounds like it’s going to require massive amounts of work, fear not! Most scholarship materials can be recycled and used across multiple applications. With each completed application, the remaining ones become easier to complete.

Now that that’s out of the way, it’s time to get into the nitty-gritty of how you should actually apply for scholarships.

Step 1: Understand the scholarship’s mission

I see most students quickly jump to the scholarship application essay prompts to see how many essays they have to write, how long they need to be, and what they need to write about.

The top scholarship earners take a step back and first review the scholarship and scholarship organization’s missions, which can easily be found on scholarship websites and brochures. By understanding these missions, your child can demonstrate a strong sense of “fit” between them and the type of person the scholarship selection committee is actually looking to fund.

For example, your daughter should write an essay with a different bend if a scholarship’s mission is to fund women in science vs. women who are dedicated to community service.

Moreover, understanding a scholarship’s mission will help you ask recommendation letter writers to discuss specific qualities and accomplishments that fit with the scholarship committee’s goals.

Step 2: Pay careful attention to recommendation letter requirements

Many scholarships will require you to submit between one and three recommendation letters.

Moreover, instructions will typically specify from whom the scholarship committee wants to receive letters. Some will want to see letters from teachers/professors, others from mentors and community leaders, or some combination.

Given that many teachers, professors, mentors, and community leaders are busy people and get asked to write many recommendation letters for college admissions, scholarships, and job applications, it’s important to ask them for letters ahead of time. Additionally, recommendation letter writers who have advance notice usually write stronger letters because they have time to mull over your child’s wonderful qualities and accomplishments.

I encourage your child to request recommendation letters 6–8 weeks in advance. If that isn’t possible, a 4-week notice could also work. Your child should also ask the recommendation letter writers if and when they would like a reminder to submit their letters, and also request to be notified when they’ve submitted their letters.

In addition to giving recommendation letter writers advance notice, it’s important to ask recommendation letter writers to include specific pieces of information about qualities and accomplishments that fit with the scholarship’s mission. For example, if your son is applying for a scholarship given to students of Jewish descent, he could ask the recommendation letter writer to highlight specific involvement with the Jewish community.

Finally, if the application instructions ask that your recommendation letter writer send their materials via regular mail, I encourage your child to provide the letter writer with a stamped and addressed envelope out of courtesy.

Step 3: Request all transcripts and standardized test scores

I recommend requesting multiple copies of official transcripts and standardized test scores 4–6 weeks prior to the first application deadline. That way, they can easily be included in all applications that will be sent via regular mail.

Online applications are no exception. Some official transcripts and standardized test scores could take weeks before getting mailed out, so it’s best to have them sent out as soon as possible.

Step 4: Write scholarship application essays

Most reputable scholarships will ask your child to submit one—sometimes two—scholarship application essays.

Writing fantastic scholarship essays is critically important for the following reasons:

They factor very heavily into scholarship decisions

Great scholarships essays can be recycled over and over again with slight modifications for many scholarships

Writing great scholarship application essays requires a similar approach to writing great college application essays and supplemental essays. The best ones accomplish the following:

Convey your child’s unique qualities and core values through relatable, everyday stories

Start in the middle of the action to hook the reader from the first sentence

Demonstrate your child’s thoughts, insights, and emotions through detailed examples

In any case, here’s a proven, step-by-step approach to helping your child find the right topic to write their scholarship essay about:

1. Revisit the scholarship’s mission

First, your child should review the scholarship’s mission to understand what type of students the scholarship committee is hoping to fund. Do they want to fund current and future leaders? Resilient individuals? People who have a heart for promoting diversity?

By gaining a good grasp of what scholarship committees are looking for, your child can tailor their essays to demonstrate the strong sense of “fit” discussed earlier.

2. Choose which qualities and core values to highlight

Rather than jump into writing about involvement in a particular extracurricular activity, your child should reflect on which of their great qualities and core values they want to convey in their essay.

If your child has a hard time thinking about what makes them unique and wonderful, you could tell them what comes to mind when you think of them. Moreover, you should encourage them to ask their friends, relatives, or mentors. Oftentimes, what your child thinks they’re known for can be very different from why people really enjoy being around them.

Once your child lists 5–10 qualities and core values, it’s time to decide which one or two to focus on. Ideally, one or more items on your list will be an exact or close match to the types of students the scholarship committee is hoping to recruit; your child should choose to convey those.

3. Consider times when those qualities and core values are or have been demonstrated

Suppose your child is interested in conveying one or two of the following qualities in their scholarship essay:

Persistence

Sociability

Practical

Accepting

Courteous

Moreover, suppose the scholarship committee is looking to fund students who want to promote diversity in their local community. The question then becomes: Has there been a time when your child demonstrated their persistence/sociability/practicality/acceptance/courtesy while promoting diversity in their local community?

Whichever quality the answer is “yes” for, that’s the topic your child should write their essay about.

A quick note on scholarships that don’t require your child to write essays: While it doesn’t hurt to apply to such scholarships, the odds of ever receiving even one of these scholarships is very slim because so many students apply for them. I recommend that your child focuses their efforts on scholarships that require essays.

(Suggested reading: 12 College Essay Examples From Top-25 Universities)

Step 5: Submit your scholarship applications exactly as instructed

Most scholarship committees prefer to receive applications in particular ways. Some want grades and test scores sent directly from institutions, whereas others want everything to be included in the same envelope. The same variability applies to how scholarship committees want to receive recommendation letters, whether they want you to write a cover letter, etc.

Bottom line: Follow those instructions very carefully to ensure that your child does not make the wrong first impression when there are thousands of dollars at stake.

Step 6 (sometimes): Complete the interview process

A few of the most prestigious scholarships also require finalists to interview as part of the application process. While scholarship interviews can take on many forms, you can offer the following pieces of guidance to your child for all of them:

You control what scholarship committees learn about you and what you learn about them. So, expand on your answers to demonstrate your qualities, and ask the interviewer questions about the scholarship and their insights throughout the interview.

Prepare for what you can.

Reduce anxiety about the interview environment by arriving early and, if possible, visit the interview location beforehand.

Dress appropriately—a suit and tie, or a pant suit or skirt suit

Practice answering common questions, such as:

“Why do you feel you’re a good fit for this scholarship?”

“What will you use this scholarship for?”

Scholarship interviews begin before the meeting and end after it. In other words, you should:

Respond promptly and professionally to all contact efforts, including by phone and email.

Treat everyone you interact with before, on, and after interview day with kindness and respect, including administrative staff and interviewers.

Follow up your interview with a thank you note.

Step 7: Repeat Steps 1–6… over and over again

----

Part 4: What to do after receiving a scholarship award

After you’ve finished celebrating with your child and ensuring that they’ve expressed their sincere thanks to the scholarship committee for their generosity, there’s one final thing to do.

But I need to provide some quick background on how colleges use scholarships before I tell you what it is. When colleges offer your child financial aid, they break things down by listing:

Sources and amount of grant funding

Sources and amount of loan funding

Amount of work study eligibility

Colleges ask to be notified every time your child wins a scholarship. They can then modify their financial aid offer based on the amount of scholarship money your child received.

Unfortunately, some colleges reduce the amount of grant money they offer when your child receives a scholarship—sometimes dollar for dollar—effectively pocketing and negating your child’s scholarship.

Therefore, it’s important that you find out the following two pieces of information soon after your child receives any scholarship:

Whether your child’s college replaces their grant funding with your child’s scholarship

Whether the scholarship organization sends the scholarship check directly to the college or to your child

If your child’s college does replace their grant funding with your child’s scholarship, you’ll have the following options:

Notify the scholarship organization of the college’s financial aid practices, ask them to send your child the scholarship check directly, and don’t report the scholarship to the college.

Report the scholarship to the college, knowing that they will replace their grant funding with your child’s scholarship.

The decision of how to handle this dilemma represents an ethical gray area in the college admissions consulting world and is entirely up to you. Nevertheless, I want to ensure that you make your decision with complete information.

Final thoughts

With college costs rising every year, obtaining the maximum possible amounts of grants and scholarships is more important than ever to reduce or eliminate your child’s and family’s debt.

Given that the specific amount of grant funding your child receives is dependent on your family’s income and otherwise largely outside your control, scholarships remain the best way to supplement paying for college costs. And beyond the “free money” aspect, applying for scholarships offers some of the best returns on your invested time—financially as well as for your child’s résumé.

Rather than looking for scholarships blindly, it pays to know where to search.

The four major sources of scholarship searches—online scholarship databases, college applications, counselors, and manual searches for private scholarships (i.e., niche scholarships)—should all be used to maximize your child’s scholarship options. Once you identify scholarships your child is eligible for, it’s critically important to organize scholarship information using a simple spreadsheet and apply for as many scholarships as possible.

Still, there’s an art and science to effectively applying for scholarships. The best applicants take the time to understand the scholarship’s mission and prepare their application materials with that mission in mind to demonstrate a high level of “fit.”

Finally, once your child receives a scholarship, you must understand how the scholarship money will be disbursed to ensure that it reduces your child’s financial obligations rather than the college’s financial promises. This creates a complex decision that is entirely your choice and should be made with the full picture in hand.

Best of luck! And if you found this guide to finding and winning scholarships helpful, all I ask is that you share it with your friends, family members, and child’s school.

----

Part 5: Frequently asked questions

Below is a list of the most frequently asked questions I receive about finding and obtaining scholarships that are not answered in this guide.

I encourage you to ask any other questions you have about college scholarships in the comments section below. I’ll make sure to answer your questions within 24 hours and add some of them to this FAQ section to make it easier for other families to find this information.

Can my child apply for and receive the same scholarship multiple times?

Yes, some scholarship committees do offer this opportunity. Whereas this information is sometimes posted on the scholarship’s website, it isn’t always. When this information isn’t posted, I encourage you to contact the scholarship organization directly.

How soon before application deadlines should we begin working on a scholarship?

Ideally, you should begin working on a scholarship 6–8 weeks before it’s due to ensure that your child’s recommendation letter writer has enough time to write a strong letter, that you can obtain all of your child’s transcripts and test scores, and that your child can write a stellar scholarship essay.

Do scholarship applications require you to submit test scores?

Yes, an estimated 70 percent do. I encourage you to visit the scholarship’s website and search for this information 6–8 weeks before its application deadline.

Should I ever pay a scholarship application fee?

You should never have to pay for legitimate scholarships. If you are ever asked to pay a fee to submit your application or receive your scholarship, you have come across a scam.

Does the information in this guide apply to finding and winning graduate school scholarships as well?

Absolutely. In fact, many scholarships and fellowships require applicants to be enrolled in or accepted to graduate school at the time of application. Moreover, I used the same approaches I describe above to complete my PhD in clinical psychology debt-free and with money in my pocket.

Can you tell me how merit scholarships work?

In contrast with (financial) need-based scholarships, merit scholarships* are most often awarded based on academic (i.e., grades and test scores), athletic, or artistic merit. However, there are many other merit scholarships that focus on community service, professional experiences, or leadership skills.

Still, when parents ask about merit scholarships, I assume they want to know about "full-ride" or "partial-ride" scholarships offered by colleges. These scholarships are awarded largely based on academics and can further be divided into automatic and competitive scholarships.

To receive an automatic full-ride or partial-ride scholarship, your child must meet a set of minimum academic requirements. If your child does meet these requirements, they automatically receive the scholarship.

On the other hand, competitive full-ride or partial-ride scholarships require your child to meet a set of minimum academic requirements just to be eligible. In other words, the scholarship is not guaranteed, even if your child meets the minimum academic requirements. For these scholarships, a committee will review your child's application and decide whether or not to offer them the scholarship.

*Note: Merit scholarship is a general term that covers all scholarships that are not need-based. The information contained in this guide covers what you need to know for over 95 percent of all merit scholarships.